About AML

Anti-Money Laundering

Almost all jewelry businesses in the United States must comply with Anti-Money Laundering laws and regulations. This includes foreign-based businesses who have a presence in the US. This set of laws is sometimes referred to as “AML”, “PATRIOT Act”, or “KYC/Know Your Customer” rules.

If you qualify as a dealer (you buy and sell $50,000 or more in precious metals, precious stones, or jewelry for which 50% of the value is derived from precious stones or precious metals), you must create and implement a comprehensive anti-money laundering program. JVC offers multiple services to help any jewelry business get into compliance with these regulations. JVC can also provide you a written guide or come to your business in person to help you set up or test your program.

Together with The Jewelers Mutual Group, you can now use the JewelPAC® program, an online joint-offering that makes AML compliance easy.

Watch our Ask the Expert video excerpt for more information about AML!

JVC’s AML Services

JewelPAC®: Online AML Compliance Development with Jewelers Mutual

Together with Jewelers Mutual, we’re now offering JewelPAC® : a new and improved online AML program resource. JewelPAC® combines JVC’s expertise regarding legal issues impacting the jewelry industry with Jewelers Mutual’s trusted guidance. You can avoid the stress of manually creating an AML program by using this proprietary software program that automatically creates the customized AML program documents required! Save time by administering employee education and training directly to your staff, and gain peace of mind with automatic updates that help keep your program up-to-date. Jewelers Mutual hosts this program for us, and you can find it on their website here.

Developing your AML program and policies

JVC’s PATRIOT Act Compliance Kit (“PACK”) is designed to help individual businesses develop an anti-money laundering program and policy that will ensure their compliance with the PATRIOT Act requirements. However, many businesses prefer to have more hands-on help as they walk through the steps necessary to achieve compliance. For those who are interested in one-on-one assistance, JVC is available to work with you to design and develop your anti-money laundering program.

Training your employees on AML law and policies

As part of the anti-money laundering requirements under the PATRIOT Act, each company that is subject to the rules is required to develop and implement a training program for employees. Training is required for all employees who may be involved in the purchase and sales of covered goods that might expose your business to the risks of money laundering or terrorist financing attempts. If you prefer to make use of JVC’s expertise on this issue, JVC is available to conduct training for your employees. JVC will provide your company with a written employee-training program and will train your employees to recognize and deal with money-laundering attempts within the scope of their employment. At the completion of the training program, JVC will provide a record of the successful implementation of the employee-training program.

Testing your AML Program

Government regulations specify that each company’s anti-money laundering program and policy be tested periodically to ensure that an adequate program is monitored and maintained. This testing needs to be done approximately once a year by an independent entity; specifically, it may not be conducted by your company’s compliance officer. A company employee or an outside party, such as the company’s accountant or attorney, who is familiar with the AML rules and your company’s business, may conduct the testing.

However, JVC is also available to test your company’s anti-money laundering program and policy. As part of its services, JVC will review and test every element of your AML program – your risk assessment, the functioning of your Compliance Officer, your AML Program, and the training you provide to relevant employees. JVC will pay special attention to any high risk functions and/or transactions in which your company engages. Our expert attorneys are available to test your AML program. JVC’s independent testing services are far less costly than outside counsel or an accounting firm. JVC will issue a results letter on your AML program implementation which can be used to demonstrate your compliance to your bank or to the IRS. There is a fee for this service.

Quick review of AML programs

For a small fee, JVC will review your AML program to make sure you complied with all the required steps. This service will check to see if you have complied with all the required elements of compliance.

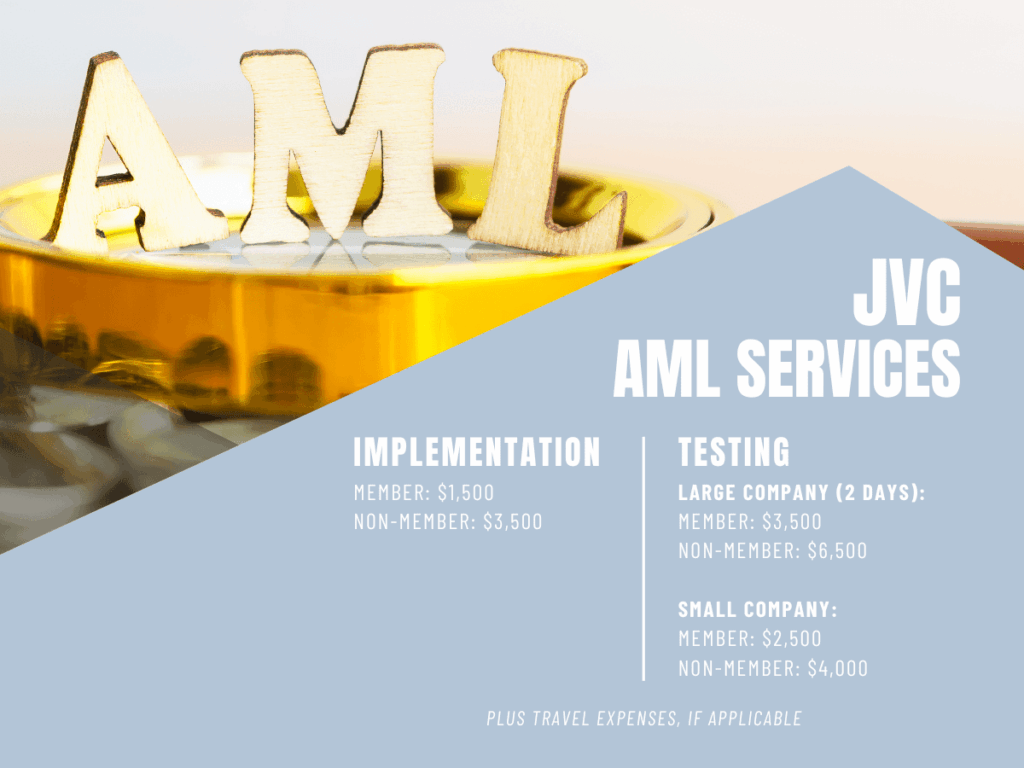

Cost of JVC AML services

Do You Need an AML Program?

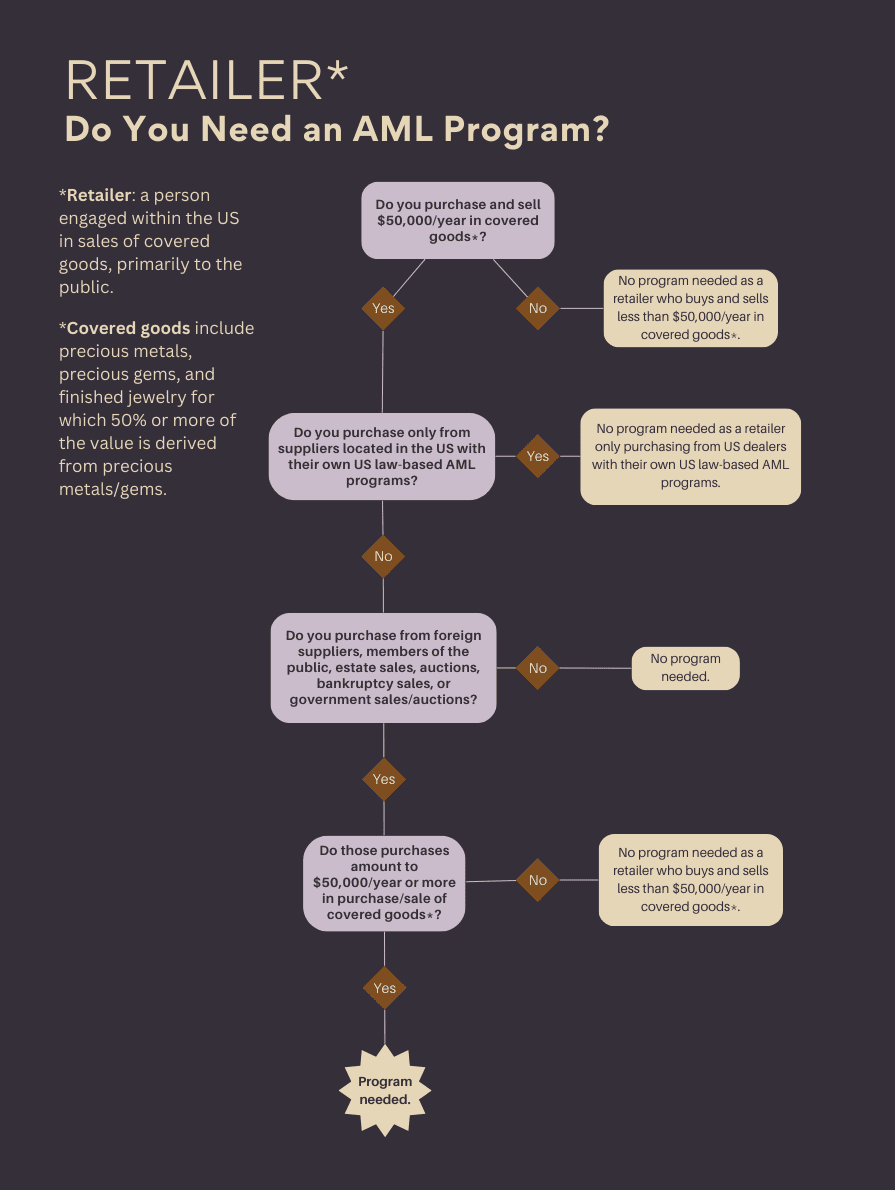

I'm a Retailer

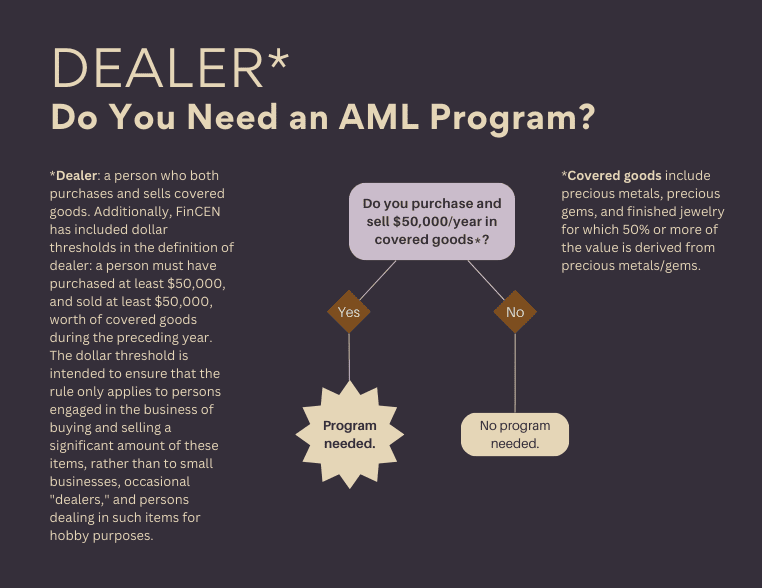

I'm a Dealer

Links to Government Lists and Forms

The U.S. Office of Foreign Assets Control - Sanctions Lists

The United States government restricts involvement with certain foreign countries, persons and entities pursuant to several sanction programs. The Office of Foreign Assets Control (OFAC), part of the U.S. Treasury Department, maintains lists of countries and entities that are subject to these sanctions.

It is very important that you check these lists and that you do not enter into prohibited business transactions with the countries, individuals or entities cited:

- The Specially Designated Nationals List is a list of individuals and entities controlled by targeted countries, or designated under programs that are not country-specific. In general, no U.S. person may engage in any activity with anyone on the list. To access this list, go to: https://sanctionssearch.ofac.treas.gov/. The alphabetical list is available in pdf format and is word searchable from the toolbar.

- List of Sanctions Programs – OFAC administers several embargoes maintained by the U.S. against other countries. Exports to these countries or other business dealings may be prohibited. To access a list of these sanction programs, go to: http://www.treasury.gov/resource-center/sanctions/programs/pages/programs.aspx

It is important that businesses become familiar with these lists, and with the sanctions programs administered by OFAC. While jewelry companies are not required by the U.S. Patriot Act to review the OFAC lists, a company will be subject to penalty if it engages in a prohibited transaction with a listed country, person or entity. Many businesses check the lists on a periodic basis as part of their anti-money laundering program. For more information about sanctions programs generally, visit the U.S. treasury resource center webpage at: http://www.treasury.gov/resource-center/sanctions/pages/default.aspx

Other U.S. and International Lists

Non-cooperative countries and territories (Financial Action Task Force):

FATF monitors countries for cooperation with AML efforts and lists those countries that are non-cooperative. Check this site for updates: http://www.fatf-gafi.org/topics/high-riskandnon-cooperativejurisdictions/

Denied persons list (Bureau of Industry and Security, U.S. Department of Commerce):

Check the parties to your international transaction against this and other lists to identify persons that are restricted or prohibited from engaging in U.S. export transactions. Find the denied persons list at: https://www.bis.doc.gov/index.php/policy-guidance/lists-of-parties-of-concern

Unverified List (Bureau of Industry and Security (BIS), U.S. Department of Commerce):

This is a list of foreign persons who could not be verified pursuant to BIS protocols. Any transaction with a listed person raises a red flag that you may be in violation of an export regulation. Check the list at: http://www.bis.doc.gov/enforcement/unverifiedlist/unverified_parties.html

The Entity List (Bureau of Industry and Security (BIS), U.S. Department of Commerce):

This is a list of foreign persons and entities that are subject to specific license requirements for the export, re-export and transfer (in-country) of specified items. Check this list at: http://www.bis.doc.gov/entities/default.htm

Consolidated List of Individuals and Entities Belonging to or Associated with the Taliban and al-Qaida (United Nations):

Information on the Agencies and Organizations responsible for the lists

General AML Frequently Asked Questions

Do I have to comply with the USA Patriot Act?

FinCen (Financial Crimes Enforcement Network), a U.S. government agency, issued the final rules requiring “dealers” in precious metals, precious jewels and stones to institute anti-money laundering (AML) programs. Compliance was required as of January 1, 2006.

According to these rules, you must institute an AML program if:

You are a dealer, meaning, you purchased “covered goods” (precious metal, jewels and stones and finished goods) in an amount in excess of $50,000 during the prior calendar or tax year and received more than $50,000 in gross proceeds from the sale of precious metal, jewels and stones during the same period. The calculation of the value threshold for purchase and sale is limited to the value of the precious metal, precious jewels and stones only.

If I am a retailer, do I still have to comply?

There are important exceptions for retailers. Retailers (those selling primarily to the public) may not need to implement an AML program if they qualify for one of the following exceptions:

- If a retailer purchases only from other dealers (as defined above) who implement an U.S. AML program, they do not need to comply.

- If a retailer purchases from non-dealers, such as members of the public and foreign sources of supply (to whom the US rules do not apply), and the value of the covered goods is less than $50,000, they do not need to comply. If the value of the covered goods is more than $50,000 in any one calendar or tax year, they must comply.

Trade-ins do not count towards the $50,000/year threshold, as long as they did not include providing funds of any kind to the customer in exchange for trade ins of such covered goods.

I am a dealer in antiques, selling primarily to other dealers and to retail stores. what are my compliance obligations?

You must establish an AML program if during the year, the value of precious metal, jewels or precious stones contained in the antiques you purchased was more than $50,000 and the value of the jewels, precious metal and precious stones accounted for 50% or more of the purchase price and you sold antiques that contained more than 50% in jewels, precious metals or precious stones, and the value of the jewels, precious metal or precious stones comprised more than 50% of the selling price of those antiques.

My business is a large corporation with a board of directors. Are my compliance obligations different?

The board of directors of the company should pass a resolution supporting and endorsing the AML program. Further, if there are multiple outlets of the company, you should be sure that all relevant employees in each outlet or store location are trained. You might want to consider appointing a compliance committee, along with your compliance officer.

What jewelry industry members must comply?

Refiners, wholesalers, traders, importers, manufacturers, retailers, suppliers, pawnbrokers, and those who buy from the public.

I run an internet auction site for jewelry but do not buy or sell diamonds or jewelry myself. Do I need to have an anti-money laundering program?

If you do not purchase or sell precious metal, stones or jewels you do not need to comply with the anti-money laundering rules. If you take no ownership interest in the products sold at auction, the rules do not apply to you.

I am a diamond broker, finding buyers for my clients. I do not own the diamonds that are sold using my services. Do I need to have a written anti-money laundering program?

No, if you do not take any ownership interest in the diamonds you find for sale, you do not have to comply with the anti-money laundering rules.

What does an AML program have to include?

Your AML program has to include five parts:

- Appoint a compliance officer

- Perform a risk assessment

- Write an AML program and policy document

- Train employees on the AML program

- Perform periodic testing of the AML program

If I verbally instruct my employees to be aware of attempts to use our business to launder funds, is this sufficient compliance?

No, the rules require the five different elements described above.

Can JVC help me develop my company’s AML program?

Yes, JVC can help! We developed the USA Patriot Act Compliance Kit (PACK), an easy to use and understand system that guides you through the steps necessary to develop your company’s AML program.

What is included in JVC’s PACK?

JVC’s pack includes forms and templates on a thumb drive that you can customize for your business; a “Quick Start Guide” to help you start – and finish – your AML program in less time than you think; access to JVC’s AML experts to ask questions about compliance; and an employee training video and customizable training modules.

I have received many letters from my vendors asking about whether I comply with the USA Patriot Act. Under the rules, I am an exempt retailer and have no compliance obligations. What should I tell the senders of the letter?

If you are a retailer who does not have to comply because you qualify for the retailer exemption, then you should inform your vendors of that fact. You will still have to provide identification information, if asked, in order for your vendors to complete their program.

I have written my risk assessment, but I have added a new activity to my business. Do I need to amend my risk assessment?

When your business model changes, you should evaluate whether your new business model presents any additional risks for attempts to use your business to launder illegal funds or finance terrorism. The update to your risk assessment and any changes to your AML program and policy should be documented, and your relevant employees trained in the changes.

My company is international, with no presence of any kind in the US. I have many retail customers in the US who buy goods from me, either via the internet, or because they visit me at the Hong Kong and Bangkok trade shows. Do I need to comply?

If you have no physical presence in the U.S., you have no need to comply with U.S. law. However, if you choose to comply with the USA Patriot Act, you may reassure your retail customers that you are implementing an anti-money laundering program, even if your local jurisdiction does not require it. If your local jurisdiction does require an anti-money laundering program, you should inform your U.S. retail customers that you are fully compliant with your own legal obligations in this area.

My company is international. I exhibit annually at a few trade shows in the US. Do I need to comply with the USA PATRIOT Act?

Yes. If a foreign company has a physical presence in the U.S., including exhibiting even at only one trade show, and you otherwise fit the definition of a “dealer” (you purchase and sell $50,000 or more of precious stones jewels or precious metal) in any one calendar year then the company must comply with the USA PATRIOT Act requirements. The JVC PACK can help you to understand the rules, and how to best comply.

When will the IRS begin to examine dealers for compliance?

The IRS, which is the agency assigned the responsibility to enforce the USA PATRIOT Act rules, began to perform examinations for dealers as of June 2006.

If the IRS is going to examine my AML compliance program, what should I have ready?

You should have all of the documentation you created appointing your compliance officer, performing your risk assessment, creating your written AML program, and records of your employee training. If you have tested your program, you should have that documentation as well. If you have had incidents where you have made inquiries pursuant to your program, filed any documents with the government, or responded to inquiries, etc., you should provide documentation on this as well.

If the IRS is examining my company for AML compliance and I have not yet performed the testing because I have not had my program in place for one year, am I out of compliance?

No. Your AML policy should state when the program would be tested, usually within one year from inception. Therefore, if you are examined in advance of that one-year, you do not need to perform the testing in advance of the period set out in your program.

I received a check from the brother in law of my customer in payment for some product that I sold. What should I do?

You should make an inquiry to your customer about the third-party, following your “Know Your Counterparty” procedure. Find out why you have received this third-party check. If you are satisfied with the answer, you should fully identify this third party and then may proceed. If you are not satisfied with the answer, you should decline to engage in this transaction. Either way, you should document what transpired in your AML documents (if you have the JVC PACK, you would make an entry on your AML log sheet for this transaction.)

If I do not get answers to all the questions I ask of my customers and suppliers, but still believe that there is no risk for money laundering or terrorist financing connected to the relationship or the transactions, can I proceed with a transaction?

Nothing in the rules requires you to suspend a relationship or refuse to deal with a company or person unless you suspect that they are using your business to launder illegal funds, or are in the process of financing terrorism. However, if you do have real suspicions, and you choose to ignore those suspicions, you risk being found to be part of the criminal conduct.

Am I required to report any suspicious activity in order to comply with the rules?

There is no requirement in the rules for you to report anything to anyone. However, it is probably a good idea to determine whether a particular activity rises to the level of suspicious activity which appears to have an illegal source or purpose or when the transaction has no apparent business or lawful purpose. If so, you can use the government’s Suspicious Activity Report (“SAR”) form to report this activity. SARs can be filed online here: https://bsaefiling.fincen.treas.gov/main.html

My business is a manufacturer, but we did not do business (buying and selling precious metals, stones or jewels) in the amount of $50,000 this year. For next year, however, I got a new contract worth $200,000. When do I need to comply?

Technically, when you reach $50,000 in gross proceeds from the purchase and sale of precious metal, jewels and stones, your compliance obligation starts. But why wait? You know you will reach the threshold next year, so getting into compliance now will only help!

How do I calculate the value to determine if my business activities meet the $50,000 threshold?

The value you use to calculate the $50,000 threshold includes only the value of the precious metal, stones or jewels or which is contained or attached to a finished product, without including labor charges, overhead or profit margin.

Do I have to do anything different when accepting a cash payment?

If you accept cash in the amount of $10,000 or more for a transaction or a series of related transactions, you must file form IRS-8300. More information can be found here: https://www.irs.gov/businesses/small-businesses-self-employed/form-8300-and-reporting-cash-payments-of-over-10000

Can my auditor who does my business tax return every year be appointed the independent tester of our AML program?

Yes, this task can be added to the review by the auditor of your books and records.

Can my auditor be my compliance officer?

No, the compliance officer must be an employee of the company.

I’m the only employee of my company. Can I be the compliance officer and the independent tester?

No, you the independent tester cannot be the same person as the compliance officer. You will need to have someone outside of the company be the independent tester.

Do the PATRIOT Act AML regulations for the jewelry industry require me to track each transaction in which my business engages?

No. The rules require that you be in a position to monitor any red flags or suspicious changes in the regular course of dealing (including payment and delivery methods, chain of distribution, etc.) There is no obligation to track every individual transaction.

Special Retailer Considerations

If I am a retailer and buy from members of the public who are not "dealers" (as defined in the PATRIOT Act rules) must I comply with AML regulations?

If you buy precious metal, precious stones, jewels or finished goods from members of the public or anyone not otherwise covered by these rules (such as foreign sources of supply) in an amount in excess of $50,000 you must implement an AML program and policy. As a retailer, your AML program would address those purchases.

If I am a retailer and take trade-ins from members of the public of items previously purchased from my store, must I comply?

If you accept trade-ins from your customers of covered goods (precious stones, jewels, precious metal or finished goods which derive 50% or more of their value from jewels, precious stones or precious metals contained or attached to such finished goods) and the transaction does not include providing funds of any kind to the customer offering the trade in, these transactions should not be included in your calculation of the $50,000 threshold.

If I am a retailer and take in trade-ins of items purchased from my store or from other stores, must I comply?

As long as the trade-in does not include providing funds of any kind to the customer, you need not include these transactions in determining if you must comply.

As a retailer, I do buy more than $50,000 of precious metal, precious stones, jewels and finished goods from the public, and resell them in my store. Do I need to comply?

If I am a retailer and take in trade-ins of items purchased from my store or from other stores, must I comply?

If I am a retailer and buy in excess of $50,000 of precious metal, stones or jewels from companies not otherwise covered by the rules (such as foreign-based suppliers), must I comply?

If you purchase in an amount in excess of $50,000 of covered goods from companies who are not covered by the laws of the United States and therefore not implementing an AML program and policy under the laws of the United States, you must comply. Remember, for the purpose of determining your exception status as a retailer, calculate only the value of the precious metal, stones or jewels in the products you buy.

As a retailer who buys more than $50,000 in covered goods from a foreign source of supply, must all my retail activities be addressed in my AML program?

No. If you are a retailer and buy more than $50,000 from foreign sources of supply, your AML program need only address the money laundering risks associated with the purchases from your foreign suppliers.

I am a retailer, and I buy from estate sales and U.S. government-sponsored sales. Must I have an AML program?

If you are a retailer, and buy more than $50,000 in covered goods from non-dealers such as estate sales, auctions, U.S. government sales, bankruptcy sales, etc., you must comply. Your program would address only those purchases.

I am a person who is a hobbyist - just collecting and sometimes trading or selling items which include precious metal, precious stones or jewels. Do I need to comply?

As long as this activity does not amount to $50,000 purchases or gross proceeds from the sale of covered goods in a calendar year, you do not need to comply.

I am a retailer and sell only antique jewelry. Must I institute an AML program?

If in a calendar year, the value of the precious metal, jewels or precious stones contained in the antiques you sold was more than $50,000 and the value of the jewels, precious stones and precious metal comprised 50% or more of the selling price of those antiques, and you purchased antiques from foreign sources, the general public, or other non-dealers you will need to institute an AML program addressing your sources of supply.

Based on my calculation for this year, I need to have an AML program. How long must it continue?

If based on your activities during this year, you need to implement an AML program, you must maintain it as long as you continue to fit under the definition of “dealer” set out in the rules. If your business activity changes in the future, and you no longer satisfy the criteria for being a dealer, you do not need to continue your AML program in the following year. However, you need to continue to reassess to see if you once again fit the definition of a dealer.

Since I already comply with state laws requiring me to record purchases of jewelry from members of the public, do I need to also have an anti-money laundering program?

If your purchases from members of the public amount to more than $50,000 per calendar year (excluding trade-ins which do not result in any payment to the customer), you must also comply with the anti-money laundering rules for dealers in precious metals, stones and jewels for the following year, even if you report these purchases as required by state law. For retailers, your AML program would only address those purchases from members of the public.

As a retailer, I visit the Hong Kong show once a year to purchase inventory for my store. Other than that, I buy from US manufacturers, all of whom comply with the U.S. regulations requiring anti-money laundering programs. Do I need to have a program of my own?

If your purchases from suppliers abroad amounted to more than $50,000 this year, and your gross proceeds from sales exceed $50,000, you must institute an anti-money laundering program for the following year addressing those purchases.

My retail business buys and sells gemstones, but beside myself, there is only one other employee. We exceed the $50,000 threshold. How can I comply?

Once you meet the $50,000 threshold for a calendar year, you must comply with these rules. The number of employees is not relevant in determining whether you need to comply. The compliance officer must be an employee, and your other employee can be the tester of your program. You must have a written AML program and policy. Make sure you both understand the risks associated with your business and the written program you developed.