Keep Up to date - Sign up for our Newsletter

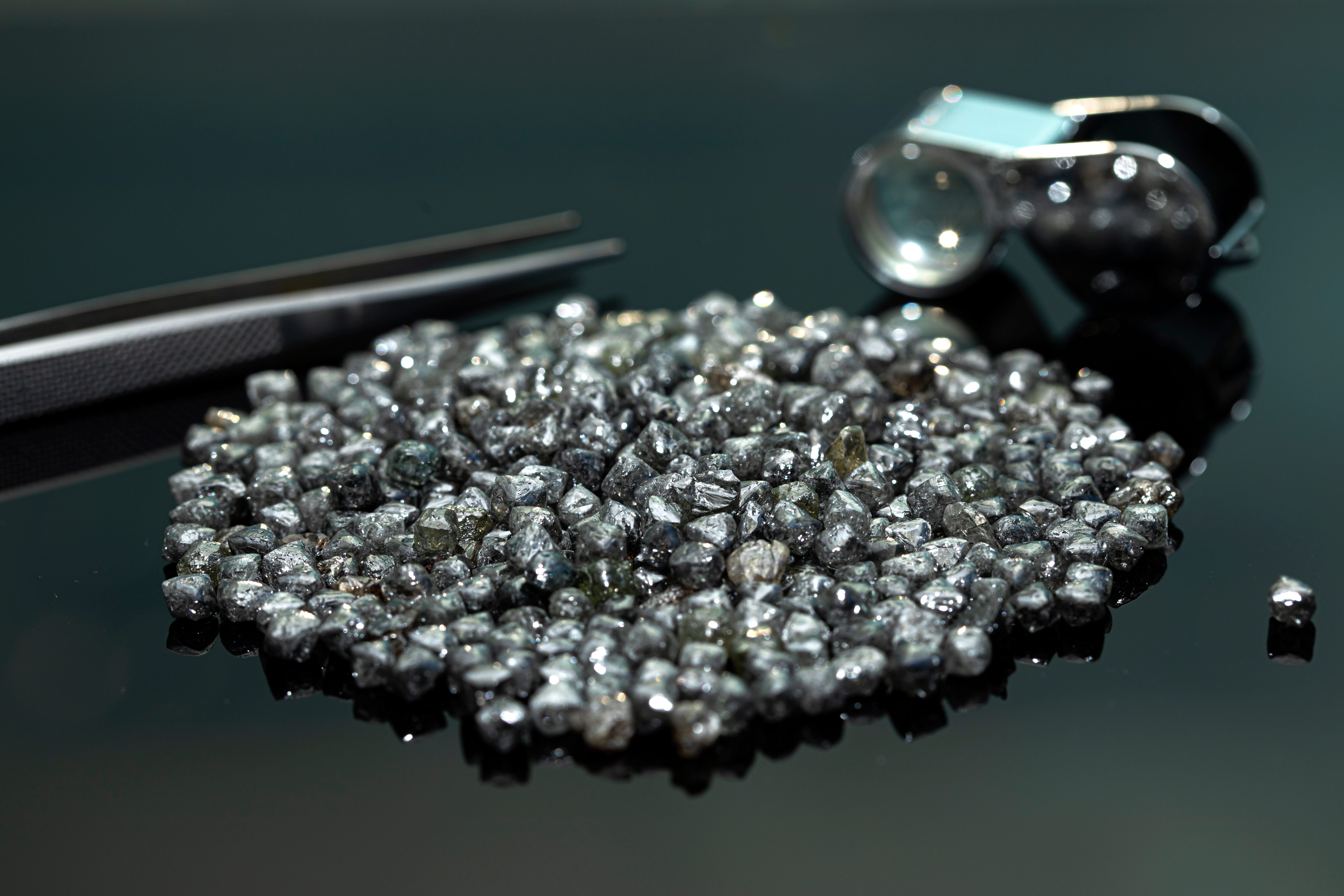

Today, the G7 government-coordinated restrictions begin on rough and polished diamonds. All G7 governments (United States of America, Canada, France, Germany, Italy, Japan, the United Kingdom and the European Union) have agreed to restrict Russian-origin diamonds of certain sizes from entering the G7, even if they are cut & polished (“substantially transformed”) in a third country before import. The purpose of the sanctions is to prevent the Russian Federation from continuing to use the financial systems of the G7 to fund its unjustified war in Ukraine. Alrosa, the state diamond mining corporation which is partially owned by the government of the Russian Federation, uses the country’s diamonds to raise revenue that directly contributes to the war in Ukraine.

In the U.S., the restriction was implemented by an Executive Order on December 22, 2023 with subsequent determinations by the Office of Foreign Assets Control and guidance from Customs & Border Protection.

Starting March 1, companies importing rough or polished diamonds 1 carat or higher must demonstrate that the diamonds were not mined, extracted, or polished in the Russian Federation. OFAC has provided some basic information in FAQs here, here, and here, including the specific harmonized tariff codes affected.

The U.S. government has given required self-certification language for shipments containing diamonds and diamond jewelry in the Customs guidance communication seen here and excerpted below. All diamond imports containing rough or polished diamonds 1.0 carat or higher must file this declaration. CBP is empowered to check for this information upon import into the U.S. and will be inspecting packages of diamonds at the point of importation into the U.S. as usual.

The self-certification for U.S. import must meet the following criteria:

For non-industrial diamonds with a weight of 1.0 carat or greater, effective March 1, 2024:

“I certify that the non-industrial diamonds in this shipment were not mined, extracted, produced, or manufactured wholly or in part in the Russian Federation, notwithstanding whether such diamonds have been substantially transformed into other products outside of the Russian Federation.”

For diamond jewelry and unsorted diamonds, effective March 1, 2024:

“I certify that the diamond jewelry and unsorted diamonds in this shipment are not of Russian Federation origin or were not exported from the Russian Federation.”

Statements regarding origin made in these declarations should be truthful; falsifying information at Customs is a federal offense. Importers can further demonstrate that their diamonds are not of Russian origin using invoice statements, chain of custody demonstration, blockchain tracking, and more.

March 1 marks the beginning of the “sunrise period” requiring self-attestations that will terminate by September 1 with the implementation of traceability technology requirements.

The following information must be available:

Businesses should have available documentation that shows proof the diamonds they are shipping did not originate from the Russian Federation. The types of documents containing the above information required for submission with entry may vary depending upon the requirements of each individual G7 country.

For shipments into the U.S., importers do not need to submit this information directly to U.S. customs, but must have it available in case of further inspection. Examples of documentation include the following non-exhaustive list:

For rough natural diamonds:

Additional documents proving the above can include:

For polished natural diamonds:

Additional documents proving the above can include:

No. For example, in the E.U., more documentary evidence of where the diamonds do originate is required. Businesses importing diamonds into other G7 countries should be sure to check with relevant customs authorities.

JVC has been providing its members with information and guidance on this topic since February 2022 when Russia first invaded Ukraine. U.S. businesses should be working directly with their suppliers to ensure the suppliers are capable of segregating their goods and providing verifiable confirmation that the goods purchased are not of Russian origin. The fundamentals of this can be built on top of a business’s existing AML program and KYC / vendor identification programs. While you need to receive ongoing confirmation about goods you are purchasing, establishing good vendor policies and procedures is paramount to ensuring you are receiving goods with verifiable origin information.

The G7 technical committee is working on a traceability mechanism for diamonds that will be tested between March 1 and September 1, the “sunrise period”. Contemplated in this system is the requirement for rough diamonds to enter the G7 via specific “nodes” for uploading onto a blockchain to ensure source verification. One node is planned for Antwerp, Belgium; additional nodes may be added (for example, a registration point in Canada directly for Canadian diamonds, which are already in the G7.) We don’t yet fully know what this looks like or how expeditiously goods will move from source countries to the node for registration to cutting factories.

The G7 has also stated that the restrictions will apply to finished jewelry, laboratory-grown diamonds, and watches starting on September 1. We don’t yet know how this restriction will be structured nor how it will be enforced.

JVC continues to work alongside the jewelry industry and with the U.S. government to clarify the requirements and provide input regarding what is achievable in the market. The U.S. government officials working on these restrictions have been incredibly open to input from the trade, and we will continue to facilitate these discussions on an ongoing basis.

JVC is tracking this information and will continue to distill it for our members. The solutions designated by the G7 are being designed to be multi-country efforts. As changes are announced, we’ll make sure you know about them.

They’re not. In the various executive orders issued on the topic, diamonds, gold, and jewelry have been lumped together with seafood and alcohol products. Seafood products, it turns out, have many of the same concerns we do; Russian pollock and other fishes were shipped to China and turned into “substantially transformed” fish sticks and other products that were being imported into the U.S. This is now prohibited by the same executive order that prohibits substantially transformed diamonds from entering the U.S. The U.S. is looking at every sector in an attempt to close off funding for the war.

All businesses in the jewelry trade need to be asking suppliers questions, evaluating those responses, keeping records of those responses, and asking questions about the technology their suppliers have/are acquiring.

Beginning on September 1, businesses importing 0.5 carat or higher diamonds, laboratory-grown diamonds, or diamond jewelry and watches containing diamonds 0.5 carats or higher will be required to implement traceability systems to ensure the diamonds did not originate in the Russian Federation. This may include the registration of rough diamonds at the diamond office in Antwerp, Belgium, before cutting and polishing. Our understanding is that multiple traceability solutions will be allowed, and that this portion of the restrictions is still in development. The traceability mechanism will be tested during the “sunrise period” between March 1 and September 1. We will continue to share information as we receive it.

Retailers should be speaking directly with their suppliers about how they plan to implement the traceability mechanisms of the G7 restrictions. Retailers should prepare staff to speak about the sizes of diamonds that are restricted from entry into the U.S. and the fact that this is being done so that diamond proceeds do not finance war.

Businesses should follow the steps for a red flag transaction as outlined in their AML programs. If you are a JVC member, please contact us so that we can help you evaluate the transaction. Potential violations can be reported to OFAC using their hotline at 1-800-540-6322. You may also wish to engage outside counsel.

JVC offers up-to-date information on sanctions in jewelry and broader used materials to help guide companies through current events. Doing business in the U...

Further to the additional sanctions placed on Alrosa on April 7, JVC has received additional guidance from our government partners that helps further clarif...

This is an edited transcript of JVC’s Compliance Briefing, held on Friday, April 8th, 2022. This Compliance Briefiing's subject was mainly the Russian dia...

What is the Kimberley Process? The Kimberley Process (KP) is an international initiative launched in 2003, after several years of discussions on ways to...

On June 26, 2022, President Biden along with the other members of the G7 announced together that they would collectively ban the importation of Russian gold...

In April 2022, the U.S. Department of the Treasury’s Office of Foreign Assets Control designated Alrosa on the OFAC Specially Designated Nationals list, ...

Below is an edited transcript from JVC's Q4 2022 Compliance Briefing held on Thursday, November 17th, 2022. JVC’s Quarterly Compliance Briefings (CB) a...

JVC’s focus on jewelry-specific legal issues include our specialized expertise on sanctions for the United States. Below are resources to help businesses navigate some of these restrictions on daily operations and transactions. Let us know how else we can help. We are here at info@jvclegal.org and @jvclegal on social platforms.

Still have questions? If you are a JVC member, you can schedule a free 15-minute conversation with a person from our legal team!

The Clean Diamond Trade Act was implemented on July 29, 2003. The act requires that rough diamonds imported or exported from the United States be controlled through the Kimberley Process (USKPA). Rough diamonds may only be legally imported and exported from the U.S. via a USKPA authorized licensee. The goal of the USKPA is to restrict the trade of rough diamonds known as “conflict diamonds.”

Conflict diamonds are rough diamonds used by rebel movements or their allies to finance conflict aimed at undermining legitimate governments.

More information on the USKPA and to become an authorized licensee can be found here.

The United States government restricts involvement with certain foreign countries, persons and entities pursuant to several sanction programs. The Office of Financial Assets Control (OFAC), part of the U.S. Treasury Department, maintains lists of countries and entities that are subject to these sanctions.

It is very important that you check these lists and that you do not enter into prohibited business transactions with the countries, individuals or entities cited:

It is important that businesses become familiar with these lists, and with the sanctions programs administered by OFAC. While jewelry companies are not required by the U.S. Patriot Act to review the OFAC lists, a company will be subject to penalty if it engages in a prohibited transaction with a listed country, person or entity. Many businesses check the lists on a periodic basis as part of their anti-money laundering program. For more information about sanctions programs generally, visit the U.S. treasury resource center webpage at:

http://www.treasury.gov/resource-center/sanctions/pages/default.aspx

Almost all jewelry businesses in the United States must comply with Anti-Money Laundering laws and regulations. This includes foreign-based businesses who have a presence in the US. This set of laws is sometimes referred to as “AML”, “PATRIOT Act”, or “KYC/Know Your Customer” rules.

JVC recommends building extra levels of sanctions compliance on top of your functioning AML program.

More information on AML services JVC offers can be found here.